ATLANTA, Ga., Nov. 8, 2023 (SEND2PRESS NEWSWIRE) — Down Payment Resource (DPR), the housing industry authority on homebuyer assistance program data and solutions, reports that homebuyer assistance program administrators are responding to the mounting home affordability crisis by rapidly rolling out new homebuyer assistance programs and funding buydowns.

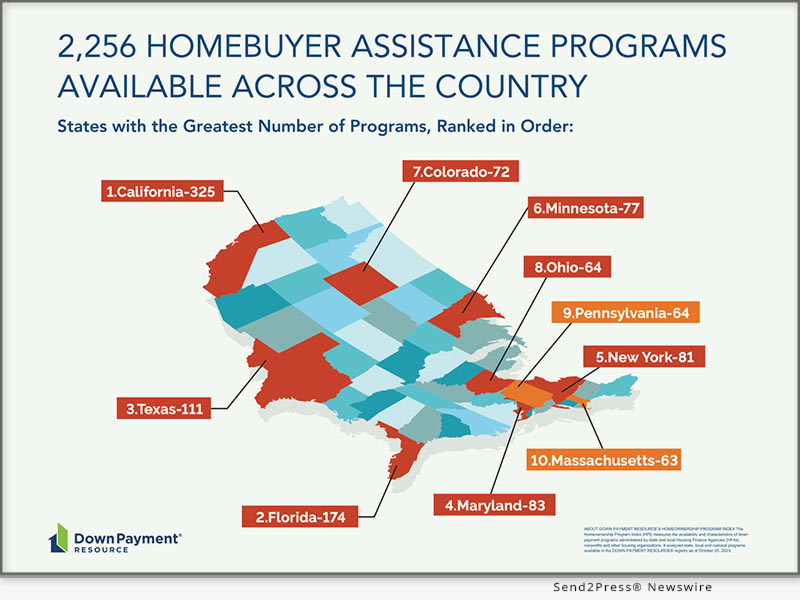

Image Caption: Down Payment Resource reports housing authorities rolled out 54 homebuyer assistance programs in Q3.

There are now 2,256 homebuyer assistance programs available to help people affordably finance homes, an increase of 54 programs over the previous quarter, according to DPR’s Q3 2023 Homeownership Program Index (HPI) report.*

“Most first-time homebuyers are well aware that interest rates are hitting generational highs and affordability is in the gutter — but what they are not hearing is that there are 2,256 homebuyer assistance programs available to help,” said Rob Chrane, founder and CEO of Down Payment Resource. “Program providers are working around the clock to ensure the programs they offer meet the needs of their markets. For this reason, many programs now allow funds to be used for buydowns and other popular financing strategies that take the edge off of monthly mortgage payments.”

Key HPI Report Findings

An examination of the 2,256 homebuyer assistance programs that were active as of October 25, 2023, resulted in the following key findings:

- 295 programs will fund buydowns. Buydowns allow borrowers to lower their interest rates by paying an upfront fee. They have become a popular financing strategy as interest rates have surged.

- 253 programs will fund permanent buydowns. Permanent buydowns allow borrowers to lower the interest rate over the life of the mortgage loan by paying an upfront fee. 11.21% of programs support these buydowns.

- 66 programs will fund temporary buydowns. Temporary buydowns allow borrowers to lower their interest rates for a defined number of years at the beginning of the loan by paying an upfront fee.

- 224 programs will fund certain upfront loan fees.93% of programs allow funds to be used to pay the upfront mortgage insurance premium (UFMIP) on FHA loans, the funding fee on VA loans and the guarantee fees on USDA loans.

- 71 programs will fund mortgage insurance (MI) buydowns. These programs allow funds to be used to lower monthly MI premiums.

- 50 new agencies began offering programs. More agencies have stepped up to administer homebuyer assistance programs as affordability worsens. Now, a total of 1,373 agencies provide assistance to aspiring homeowners, a 3.78% increase over the previous quarter.

A more detailed analysis of the Q3 2023 HPI findings, including infographics and examples of the programs described in this release, can be found on DPR’s website at: https://downpaymentresource.com/professional-resource/the-down-payment-resource-q3-2023-homeownership-program-index-report/.

For a complete list of homebuyer assistance programs by state, visit: https://downpaymentresource.com/wp-content/uploads/2023/11/HPI-state-by-state-data.Q32023.pdf.

Methodology

Published quarterly, DPR’s HPI surveys the funding status, eligibility rules and benefits of U.S. homebuyer assistance programs administered by state and local housing finance agencies, municipalities, nonprofits and other housing organizations. DPR communicates with over 1,300 program providers throughout the year to track and update the country’s wide range of homeownership programs, including down payment and closing cost programs, Mortgage Credit Certificates (MCCs) and affordable first mortgages, in the DOWN PAYMENT RESOURCE® database.

*On October 25, 2023, DPR updated the way it classifies certain homebuyer assistance programs that are available to the general public but also offer expanded benefits to veterans and military personnel. As a result of the update, DPR’s total count of U.S. homebuyer assistance programs was adjusted downward; however, its breakdowns by region, assistance type and funding source remained the same. This change reflects an evolution of DPR’s reporting methodology, not a reduction in the overall availability of homebuyer assistance. DPR normalized last quarter’s data using its new counting methodology before calculating quarter-over-quarter trends.

About Down Payment Resource:

Down Payment Resource (DPR) is the housing industry authority on homebuyer assistance program data and solutions. With a database that tracks more than 2,200 programs and toolsets for mortgage lenders, multiple listing services and API users, DPR helps housing professionals connect homebuyers with the assistance they need. DPR frequently lends its expertise to nonprofits, housing finance agencies, policymakers, government-sponsored enterprises and trade organizations seeking to improve housing affordability. Its technology is used by five of the top 10 retail mortgage lenders by volume, three of the four largest real estate listing websites and 500,000 real estate agents. For more information, https://downpaymentresource.com/.

MULTIMEDIA:

Image link for media: https://www.Send2Press.com/300dpi/23-1108-s2p-dpr-q32023-300dpi.jpg

Twitter:

@DwnPmtResource #downpaymentassistance #affordabilitycrisis #housingaffordability #mortgage #housingequity

MEDIA CONTACT:

Johnna Szegda

Depth for Down Payment Resource

johnna@depthpr.com

News Source: Down Payment Resource